what is liquidity in a life insurance policy

The notion of liquidity or the ability to get cash from a policy can. The liquidity of an asset refers to its ability to be converted into cash.

Is Whole Life Insurance Right For You Consumer Reports

If you have invested in stocks or bonds.

. Liquidity in life insurance policies relates to how quickly and easily someone can convert a policy into cash either during the insured persons life or after theyve passed. It refers to how a policyholder can easily access their policys cash value. Cash is the most significant.

In short liquidity refers to the ability of a policyholder to access their benefits promptly. In a nutshell liquidity in life insurance refers to your ability to get cash from your policy during your lifetime. You can take advantage of liquidity in life insurance policies in several ways.

What Is Liquidity in a Life Insurance Policy. In general liquidity describes any type of asset that you can exchange for cash with relative ease. When it comes to life insurance whole life and.

Liquidity refers to converting an asset into cash quickly and easily. The liquidity in a life insurance policy refers to how easy the policy can be exchanged for cash without losing its value. Depending on the context it may have a different meaning but generally liquidity describes any asset exchanging for funds relatively quickly without losing significant value.

Bill Bruce on Jun 24 2021 13700 PM. For an asset to be liquid the money doesnt just need to be available. In life insurance liquidity refers to the cash value of permanent life insurance policies including permanent life insurance universal life insurance and variable life.

With respect to life insurance liquidity refers to how easily you can access cash from the policy. In financial jargon liquidity relates to how easily you can convert your investment into cash. This is important to consider when looking at life insurance as an asset because it can be converted.

Life insurance policy liquidity refers to how fast and easily a policy can be converted into cash either while the insured person is still alive or after their passing. So what does liquidity mean when it comes to life insurance. So if something happens and you.

The concept applies mostly to permanent life insurance because it. Liquidity is a crucial consideration for life insurance policyholders. The concept of liquidity in a life insurance policy essentially applies to.

While life insurance policies are structured to provide financial security to your beneficiaries. Liquidity is the measurement or degree by which any asset can purchase or bring with its current market price that closely reflects on its value. What is Liquidity in a Life Insurance Policy.

What is the meaning of liquidity in insurance. Some life insurance policies offer cash values that can be borrowed at any time and used for immediate needs. Liquidity in life insurance refers to how easy it would be for you to access cash from your policy.

The liquidity of a life insurance policy refers to the availability of cash value to the policyholder. Life insurance policies are certainly not liquid in the sense that it can take quite some time to actually get a payout from your. What does liquidity refer to in this insurance.

Liquidity in life insurance refers to how easy it will be to obtain cash from your life insurance.

Is Whole Life Insurance A Good Investment Forbes Advisor

How To Manage Liquidity In A Crisis What To Ask Yourself In Times Of Economic Uncertainty

Find Liquidity For Estate Taxes Without Having To Sell Off Assets

What Is Liquidity And Why Is It Important Thestreet

Ultra Hni Clients Buy Life Insurance Even If They Don T Need It Now Why Liquidity A Lot Of Super Rich Families Are Asset Rich But Liquid Poor The Life Insurance Policy Becomes

Buy Sell Agreements Lincoln Financial

Basics Of Life Insurance Types Of Life Insurance Products Youtube

What Is Liquidity In An Insurance Policy

Bank On Yourself Using Life Insurance As A Source Of Liquidity Nerdwallet

What Does Liquidity Refer To In A Life Insurance Policy Insurancegenie

Life Settlement Companies What Is A Life Settlement Harbor Life

Understanding Liquidity In A Life Insurance Policy The Reardon Agency

Okbima On Twitter Your Comprehensive Wealth Management Plan Must Include A Good Life Insurance Policy Which Will In Turn Provide Liquidity To Cover Estate Taxes Inheritances For Your Beneficiaries And Increase Generational

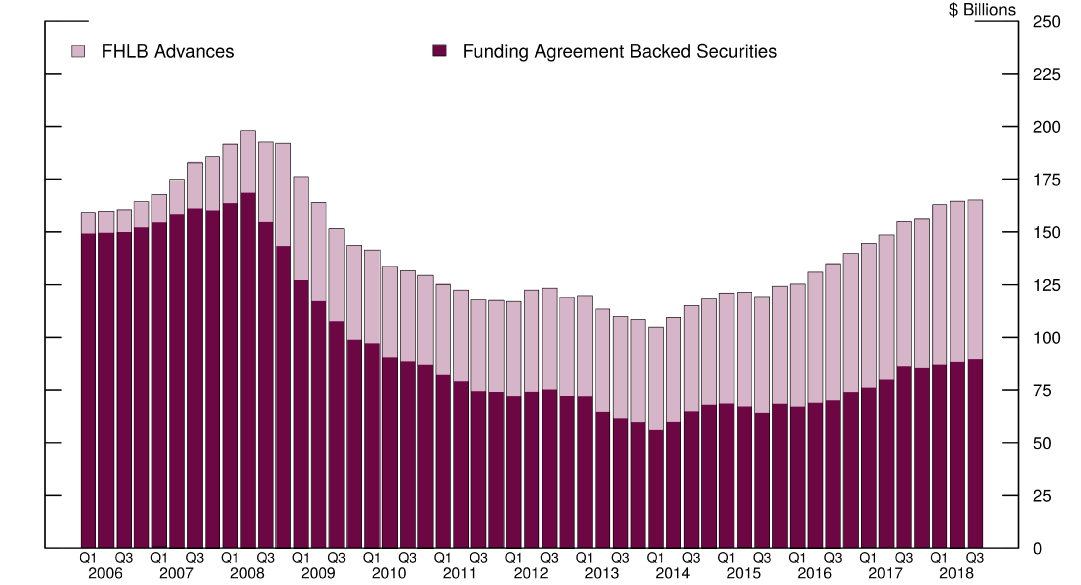

The Fed Assessing The Size Of The Risks Posed By Life Insurers Nontraditional Liabilities

What Does Liquidity Refer To In A Life Insurance Policy Everly Life

What Does Liquidity Refer To In A Life Insurance Policy

What Issues Should I Consider When Purchasing A Life Insurance Policy Isc Financial Advisors

Corporate Owned Life Insurance Spear Financial Management Corporation